Managing Workers’ Compensation Costs

Workers’ compensation provides a safety net that protects employees in case of workplace injuries or illnesses. While it ensures employees receive the care they need, it can also present a significant cost burden for businesses. The good news is that proactive strategies can be implemented by employers to manage and even reduce workers’ compensation costs, […]

Medicare Made Clear: Decoding Advantage Plans

Navigating the vast amount of information in regard to healthcare options available to seniors can be difficult. Among the many choices, Medicare Advantage Plans (also known as Part C), stand out as a great choice for many seniors.

Exploring the Many Uses of Term Life Insurance: Individual and Business Solutions

Term life insurance is one of the most versatile and affordable types of life insurance available to both individuals and businesses. It provides coverage for a specific period, typically ranging from 10 to 30 years, and pays a death benefit if the insured dies within the term.

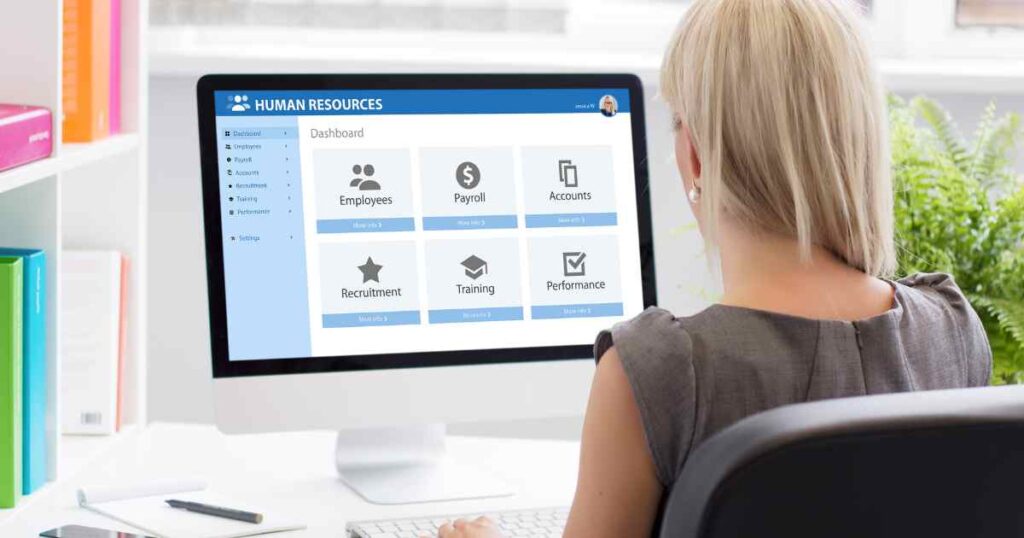

How To Develop an Effective HR Strategy: 5 Steps to Drive Your Organization Forward

People are the foundation of any business. Implementing a strategic roadmap for how you attract, manage, and retain your people can be the difference maker in the success and growth of your organization. A thoughtful and effective HR strategy not only aligns with business objectives but also fosters a productive, engaged, and satisfied workforce. The […]

The Future of HR Technology: Trends Every HR Leader Should Know

Human Resources (HR) technology, or HR Tech, is undergoing a revolution. Artificial intelligence (AI), automation, and data-driven insights fundamentally reshape how organizations manage their most valuable asset – their workforce. HR leaders who embrace these trends can reap significant benefits for their companies, including: As an HR leader, it’s essential to optimize your people strategy […]

Captive Insurance Solutions Are a Game Changer for Your Business

Captive insurance for employee benefits is a strategy where a group of employers collaborate to distribute the risk of their self-funded medical and pharmacy plans. By incorporating multiple layers of stop-loss insurance , each employer can choose a deductible level that suits their needs while maintaining high flexibility and control. This collective arrangement means risks are […]

Adding ID Theft and Personal Cyber Coverage to Your Homeowners Policy

A data breach, phishing scam, or malware attack can compromise your personal information, leading to financial losses, damaged credit, and significant stress. Adding ID theft and personal cyber coverage to your homeowners insurance policy can help you gain a crucial layer of protection against the financial and emotional consequences of these ever-evolving digital threats.

Surety Bonds: Key Facts to Know

Surety bonds offer contractors a powerful tool to enhance their credibility and financial stability. These bonds provide a guarantee to project owners that the contractor will fulfill their contractual obligations, including completing the project on time and within budget. By securing a surety bond, contractors can not only gain the trust of clients and secure […]

Navigating Environmental Risks in Construction: The Role of Contractor’s Pollution Liability

By nature of the work being done, construction projects inherently carry significant environmental risks. These can range from minimal issues like dust and noise pollution to major concerns such as hazardous material spills and leaks. These activities can profoundly impact the surrounding environment. Effectively managing these risks is crucial for successfully completing construction projects while […]

Life Insurance Beneficiaries: Who Should You Choose?

Life insurance is a powerful tool designed to protect your loved ones financially when you are no longer there to do so. However, the impact of this protection largely depends an important decision you make during the policy setup: who will be your beneficiaries? A life insurance beneficiary is a person or entity you designate […]